Textile And Garment Industry: Consumption Promotion Month Start Policy Catalyst

Industry strategy: mainstream stocks in the industry in 2012

Dynamic valuation

Relatively reasonable.

With the April order meeting, the April promotion month and quarterly disclosure, the risk factors of stock price suppression are expected to become clearer.

Some high quality brands will be the biggest catalytic factor.

April stocks recommended sorting: brand clothing plate, we recommend the sub industry followed by men's clothing, high-end women's clothing.

The promising company is

Seven wolves

,

Canal Road

,

Wedding bird

,

Lancy

Manufacturing sector, we recommend

Huafu color spinning

,

Lu Tai A.

Stock price performance:

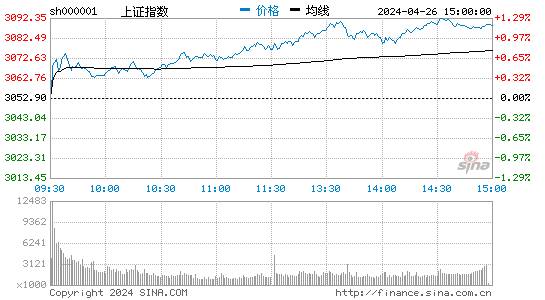

This week, the Shanghai Composite Index rose 1.93%, and the textile and garment sector rose by 3%, of which the textile sector rose 3.45% and the clothing sector rose 2.65%. This week, the textile and garment sector overall outperformed the 1.07 percentage points in the market.

This week, the leading companies in the sector were: Hong Kong share, industry and Pathfinder, or 9.90%, 9.67% and 9.05% respectively.

We focused on the company Pathfinder, Rebecca, fuanna, Semir costumes, nine Mu Wang, search special, cashmere industry, etc., and gained over 9.05% of the plate, 4.28%, 4.19%, 4.15%, 4.10%, 4.01%, 3.87% respectively.

Raw material prices:

Domestic cotton spot prices continued to fall: this week cotton price 328 index weekly average price of 19454 yuan / ton, Zhou Chengjiao average price fell slightly 0.26%, in April 6th, the paction price was 19446 yuan / ton.

Outside cotton Cotlook:A index this week week paction price slightly increased 0.31%.

The temporary cotton purchase and storage in 2011 ended. In 2011, cotton temporary storage and storage totaled 3 million 130 thousand tons. The total turnover in Xinjiang was about 1 million 700 thousand tons, and the total turnover in the mainland was about 1 million 420 thousand tons.

Cotton yarn price remained at around 31100 yuan: the average price of cotton yarn 40S index was 31100 yuan / ton this week, and the difference between 40S yarn and 328 price was 11646.25 yuan / ton this week, down 49.55 yuan / ton compared with last week.

This week, the price of chemical fiber products week fell to varying degrees, of which polyester staple fiber, polyester POY, viscose staple fiber and human cotton yarn 30S were up by -0.45%, -0.44%, 0% and -0.25% respectively.

Risk warning:

The economic recovery in Europe and the United States has repeatedly affected export demand; consumer confidence has fallen far beyond expectations, and the risk of terminal inventory has increased.

- Related reading

Good Luck Futures: Textile Exports Increased By &Nbsp; Zheng Cotton Continued To Rise.

|

Stock Market News: Stock Index Fell 0.9%&Nbsp; CPI Data Suppressed Bull Sentiment.

|- Daily headlines | Twelve Years In The Spring And Autumn Period, The Future Of Empowerment.

- I want to break the news. | Black Leather Pants, Cool Beauty Street Photo.

- Bullshit | Wear Lace Half Skirt, Sexy Princess.

- Bullshit | Guan Xiaotong Takes Part In Pandora Jewelry Activities To Show The Image Of Intellectual Temperament.

- Reporter front line | Focusing On One Yarn For Decades -- Hao Ye Displays Fashion And Creativity In The Twenty-First Jiangsu International Fashion Festival.

- Association dynamics | Chief Executive Officer Of Brazil Santos Port Authority Visits China Cotton Association

- policies and regulations | Akesu Has Already Paid 330 Million Yuan Of Cotton Price Subsidy Funds.

- Daily headlines | China Implements Tariff Collection For New US Agricultural Products Procurement

- Daily headlines | There Is No Winner In Trade Wars: Seeking Common Ground While Reserving Differences Is A Key Step In Sino US Consultations.

- Guangdong | Guangdong: US Orders Loss Market Anticipation Pessimism

- Rising Oil Prices And Rising Express Prices Are Inevitable Trends.

- A Large Number Of Consumer Goods Have Risen By &Nbsp, The Highest Increase Of 25%.

- Yang Fang, Vice President Of &Nbsp, Left The Company With A "Historic Contribution" To The Company.

- Jordan Sued Jordan For Sporting Price Exposure &Nbsp; Flying Man Offered 50 Million Claims.

- Huamao Shares Issue 840 Million Yuan Bonds

- China'S Trade Surplus Dropped To $670 Million In The First Quarter.

- Tengtai: See Inflation From A Shirt Inquiry Tour

- O2O Business Docking: Smith Barney "Touches The Net" VS All Customers "Landing"

- Winning The Terminal &Nbsp; How To Realize The Sale Of Shoes And Clothing Enterprises Terminal Technology.

- Transformation And Upgrading Is The Only Way For Industrial Clusters.